12/30/15

Is it possible to make 8% investing money in stocks every year with zero risk?

Yes.

How?

Well, by now, all investors should know that there are no longer stock ‘markets’. They have been replaced by stock ‘carnivals’. Carnivals are collections of games that are rigged by the owner of the carnival. Think of it this way. We could bet money on basketball games but surely we would not be correct all the time. In a fair game, our team would lose sometimes. But what if we bet our money on a game that was rigged? The winner was selected before the game started. So instead of betting money on an NBA game, what if we bet our money on the Harlem Globetrotters? They have only lost a couple of games in the last 50 years and will lose even fewer in the next 50 years. Why? Of course the game is rigged. The game is for our entertainment and not a true competition of basketball skills. It is an exhibition or sorts.

Since the Federal Reserve Bank seized ultimate power in their August of 2007 coup, they have been controlling stock prices for our entertainment and control. And, since we know the game is rigged to be a perpetual bull, all we have to do is wait until the fourth quarter and then place our bets. Of course, we know stocks simply have to move higher every single year from now until the end of time or the dopey citizens might suspect something is wrong. How can this be achieved?

We all know that the Fed runs the stock carnival and we all know about the PPT. Their only mandate in reality is to rig stock prices to the moon. Yes, I know. All that other stuff is just noise for the dumb folks. The only question is this. How can we use the Fed’s manipulative practices to our advantage?

There are indeed gyrations in stock prices along the way and when prices dip, it is hard to hold long positions in stocks that are now in a bubble and more over-valued than ever before. When stocks start to fall in price, our natural inclination is to sell out. But what if the risk of capital loss was removed?

As it works out, we can invest without risk if we examine the chart that I have included below. It is very simple.

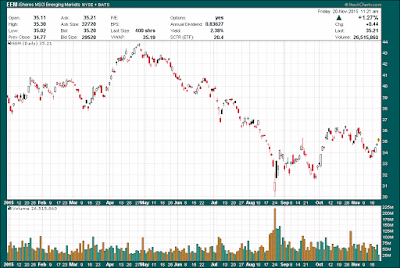

The chart is the Dow Jones Industrial average on a weekly basis for the last eight years. This is the gold line. I have traced the first three quarters of each year in blue and the last quarter of each year in green. Since 2009, the Dow has now had seven consecutive positive years. (Yes, I am writing this with only a few more trading days in the year and the Fed is fighting like mad to make 2015 positive as well by injecting stocks with fresh capital at the Yellen preferred time of 10:30 am. I’m betting they do so. Weeeeeeeeeeee!!!!!) So again, the question is how do we reduce risk to zero and still get carnival gains?

Pay attention to the green lines. Since the Fed wants us to feel richer as we keep digging our debt holes deeper and deeper, they goose stock prices every year in the fourth quarter. What if we only invested money starting at the beginning of every October and sold at the end of every December? Have we found the Harlem Globetrotter team of investing/ betting?

Okay. In the chart below, we can see that the Dow has climbed from 9000 to 18000. A double in seven years is a ten percent annual return. But, there were some nasty declines along the way that could shake even a CNBC devotee out at some point. Those are along the blue lines. Now take a look at the green lines. By my rough calculations, the Dow has gained about 9000 points since 2009 with risk mostly in the blue lines. Just following the green lines, the Dow gained some 7000 points of that 9000 with zero risk (except for a ever so slight loss in 2012 because the Fed was about to stop QE). Or, about 8% per year risk free!

Thus, we can bet on the Harlem Globetrotters to win every game as long as we only put our money to work in the fourth quarter.

In fact, if we go all the way back to year 2000, the same strategy would have worked every year except 2007 and 2008. Now the Fed is completely in charge and it looks like the Dow will climb to the sky! Nothing can stop it. The Fed has a printing press and no laws or morality to constrain it. We just have to remember that risk-free investing is only available in the fourth quarter. See the chart below for the truth.

Oh, one more thing. I drew a red line at the top of the chart noting the declining RSI since 2013. Normally, that would be a red flag indicating that the rally over the last few years is a fake. I also drew a red line at the bottom along the falling trading volume. Stock prices have risen as volume has been falling. That would also be a red flag warning that something was wrong. But nevermind. We aren’t in reality anymore. We are at a carnival and we are all winners. Weeeeeeeeee!!!!

8 years weekly DJIA

Chart courtesy StockCharts.com

Disclaimer: The views discussed in this article are solely the opinion of the writer and have been presented for educational purposes. They are not meant to serve as individual investment advice and should not be taken as such. This is not a solicitation to buy or sell anything. Readers should consult their registered financial representative to determine the suitability of any investment strategies undertaken or implemented. BMF Investments, Inc. assumes no liability nor credit for any actions taken based on this article.