Bands have a rhythm section that holds the music together. The rhythm section is generally the percussion and bass instruments. They play in harmony to drive the music and set the tempo to make the melody sound better. Stock indices today are like music. There is a band playing so our charge is to identify the rhythm section. That way, we will know the tempo of the music which will allow us to enjoy the melody.

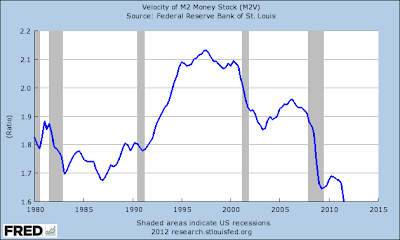

As we all know, the Federal Reserve Bank is the rhythm section of today’s stock casino. They supply the flow of money that continues to buy stocks higher. They increase the flow of money when they want a faster tempo or whenever they feel the pace dragging. Their melody is sweet and it is in the key of C Major. There are no flats or sharps. The blues will not be allowed by this rhythm section.

This week, the Fed met to announce that they would keep interest rates at zero from now until the end of time. Well, actually they said they would keep rates at zero until at least 2014 but I think we all get the message. When a nation goes $15 trillion in debt, passes a Congressional vote to add another $1.2 trillion in debt, and ignores tens of trillions in obligations, there is no way that interest rates on that debt can ever rise. Period. Even Greece, who cannot pay back a penny of their debt even with Zimbabwean dollars, is pressing for loans at no more than 3.5%. Surely a nation with an addiction to a monetary printing press like the US can print money like a drunken Zimbabwean to pay debt while demanding that interest rates stay at zero. Ben Bernanke has granted this request and will continue to pour ink into the printing press. At this current meeting, the Fed also said that some form of further easing was still on the table.

Duh. In a nation run by liars, thieves, and conmen, of course the debt has to expand. That’s the way the empire crumbles leaving the elite with the spoils. In the meantime, the elites have to keep the con going in that the US is still sovereign, solvent, and strong economically. It is neither sovereign nor solvent. Her economic strength is an illusion as she is strung out on stimulus pumped into her veins by the central bank who now sits in her saddle. The oat sack of feed that the bank hoists over her ears at night is full of debt poison. She is too ignorant to resist, too hungry for nourishment to refuse, and too weak to seek sobriety from debt. The US is simply Greece ten years ago with an exponentially greater impact to the rest of the world.

But, that’s not important, is it? All we want is an oat sack draped over our ears and we won’t resist the tug of reins in the morning. Give us a rally in stocks and we are more than happy to be saddled by a big fat man with sharp spurs. Do we not even recognize the pattern of control? Do we not understand the rhythm? Can we not tap our foot to the beat? Do we not even care that capitalism is no more and stock futures are completely controlled by a force that will ultimately destroy us all? Tap once for ‘No’ and twice for ‘Yes’. I think I know the answer to each response.

Yes, there are still two trading days to January of 2012 and the Dow is up some 3.5% year-to-date. Wonderful! Look closely at the following chart. It is a chart of the Dow in the month of January, 2011.

Chart 1. DJIA - Daily 01/03/2011 thru 01/31/2011

Chart courtesy StockCharts.com

Now look closely at the next chart (Chart 2). See any similarities?

Chart 2. DJIA - Daily 01/03/2012 thru 01/27/2012

Chart courtesy StockCharts.com

It almost looks like the same chart. Bernanke’s Fed is still playing the same song at the same tempo. Yes, last year we were in the midst of QE2 and this year we are in the midst of Operation Twist. Both operations are performed by the Fed and both are intended to keep interest rates down. At this writing, the 10-year US Treasury yield is now 1.9% and the 5-year US Treasury yield is hitting record lows. Yet, the Q4 GDP came in at a rather pedestrian 2.8%. Nothing to see here, folks. Go about your business. The Fed has it under control. Everything is fine.

So what should we expect now? Well February of last year packed on another 1.5% to the Dow and the Fed is still in all-out stimulus mode. Yes, even with interest rates at zero and and economy supposedly growing, the Fed is stimulating. With all the talk of Greece debt troubles, Euro-land debt woes, recession in Europe, China slowing, the US limping along, and political disfunction, the Fed holds the trump card. It is stimulus. POMO activity will not cease. PPT activity will not cease. The Fed will keep pumping up stocks and bonds so as to lay down the smokescreen for elitism pilfering. As long as the tempo and rhythm and tempo are steady, investors will keep dancing. QE2 gains repeated QE1 gains. Operation Twist will no doubt repeat QE2 gains. Stocks will again sag when the Fed’s latest program ends in June. They will follow with QE3 and so on. Will the Fed let February fizzle? I doubt it.

Disclaimer: The views discussed in this article are solely the opinion of the writer and have been presented for educational purposes. They are not meant to serve as individual investment advice and should not be taken as such. This is not a solicitation to buy or sell anything. Readers should consult their registered financial representative to determine the suitability of any investment strategies undertaken or implemented. BMF Investments, Inc. assumes no liability nor credit for any actions taken based on this article. Advisory services offered through BMF Investments, Inc.