As the year of 2009 and the 'decade from hell' come to a close, investors have to be looking forward to the future. Without question, we enter a new decade under completely different rules. The director of the stock market is now the Federal Reserve. Their money machine will continue to pump money into the market else the market will fail. The Fed knows this. And now, they have no choice. They have kept all the stupid people in their portfolios believing that somehow the magic of appreciating monthly statements will continue as long as they don't withdraw. The smart people know the market is broke and the Dow should be in triple digits. However, Zimbabwe has proven that markets can be grown to the clouds as long as money is flooding the streets of the exchange. So, we all play along with the con men that run the banks. If the Fed ever loses its grip, look out below.

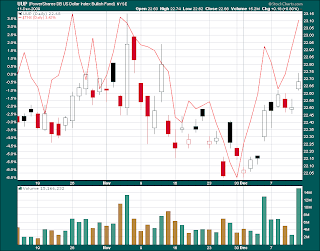

Printing money erodes its value. The chart below shows the rising dollar etf, UUP, in candlestick and the 10-year Treasury bond yield in green. It is easy to see the declining dollar. It really accelerated in March when the Fed revealed themselves as the savior of portfolios. It is, after all, their only job. Stock market manipulators to benefit their banking shills so they can control the world. Pitiful. The important thing for investors is the TRUTH. It is something that our government can't even fathom. The government lies about absolutely everything. This will continue. They cannot tell us the truth. The TRUTH is that they are broke. Maybe that's why the dollar keeps descending toward worthlessness. Maybe printing to infinity does this. What is interesting is we can see that in December the dollar suddenly appreciated. Why?

No, the world does not suddenly think the dollar is of any value. The bond yield is moving higher and will close the decade pushing 4%. Ruh-Ro! We are a debtor nation. Congress just approved a raised debt ceiling to something like $12.4 trillion. Debtors don't handle rising rates very well. Without debt, we have nothing. So, it appears that the Fed and their friends are trying to buy dollars so they can try and tamp down interest rates by buying Treasuries. Good luck fellows. The Treasury is going to issue another $500 billion in new debt in the first quarter of 2010. This worry is born out with the very heavy volume in dollar buying that can be seen in the UUP at the bottom of the chart. The question going forward is how many plates of manipulation can the Fed keep in the air? They now must manipulate the stock market, the bond market, the currency market, the mortgage market, economic data. ...

Will they soon drop a plate? Ruh-Ro!!

2009 Ytd - UUP in candlestick, TNX in green

Chart courtesy StockCharts.com